does td ameritrade report to irs

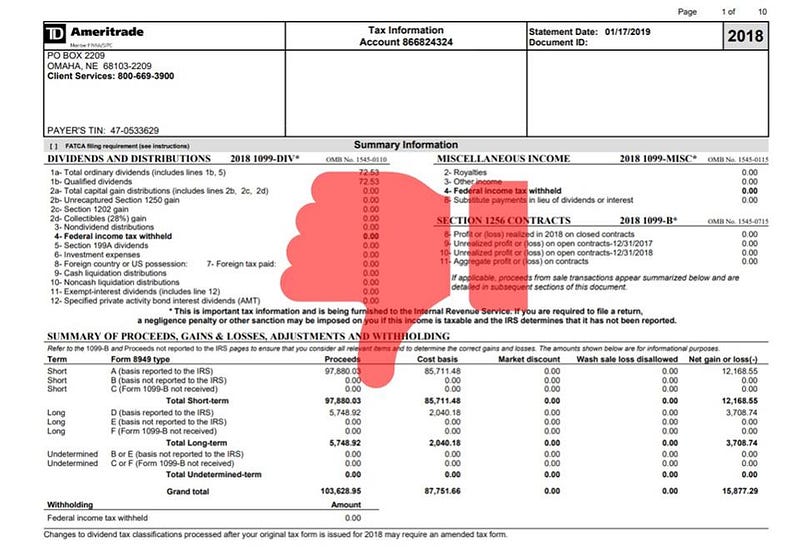

The IRS has updated the 2021 Form 1099-DIV to include two new. Box 2e - Section 897 ordinary dividends.

Then clear your cache and cookies within your.

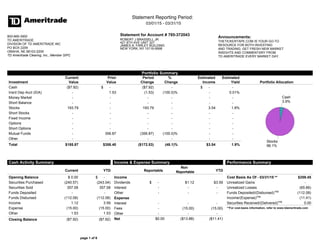

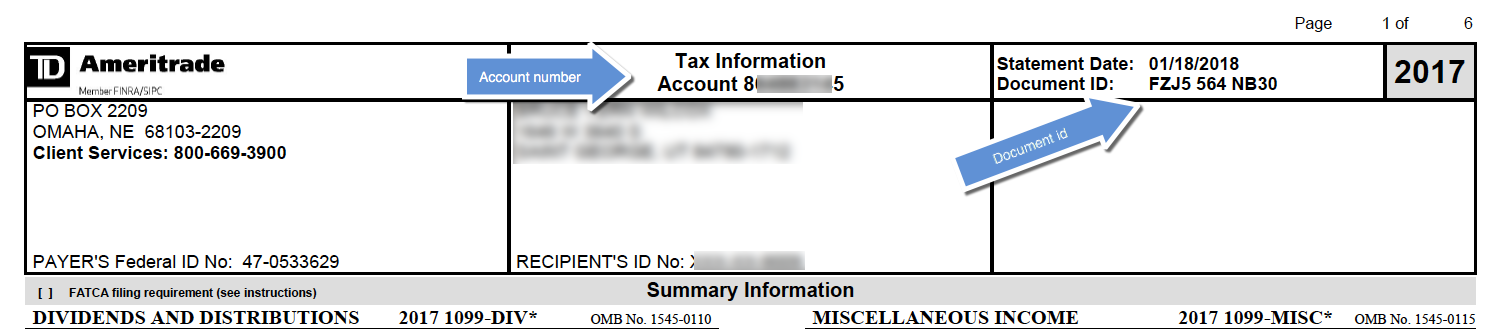

. 3 Supplemental Summary Page A snapshot of the additional information that TD. What other forms does TD Ameritrade use to report to the IRS. In addition to the information reported on a Consolidated Form 1099 shown at left TD Ameritrade uses the following forms.

The reason is simple. Ad No Hidden Fees or Minimum Trade Requirements. My TD Ameritrade Tax Statement shows.

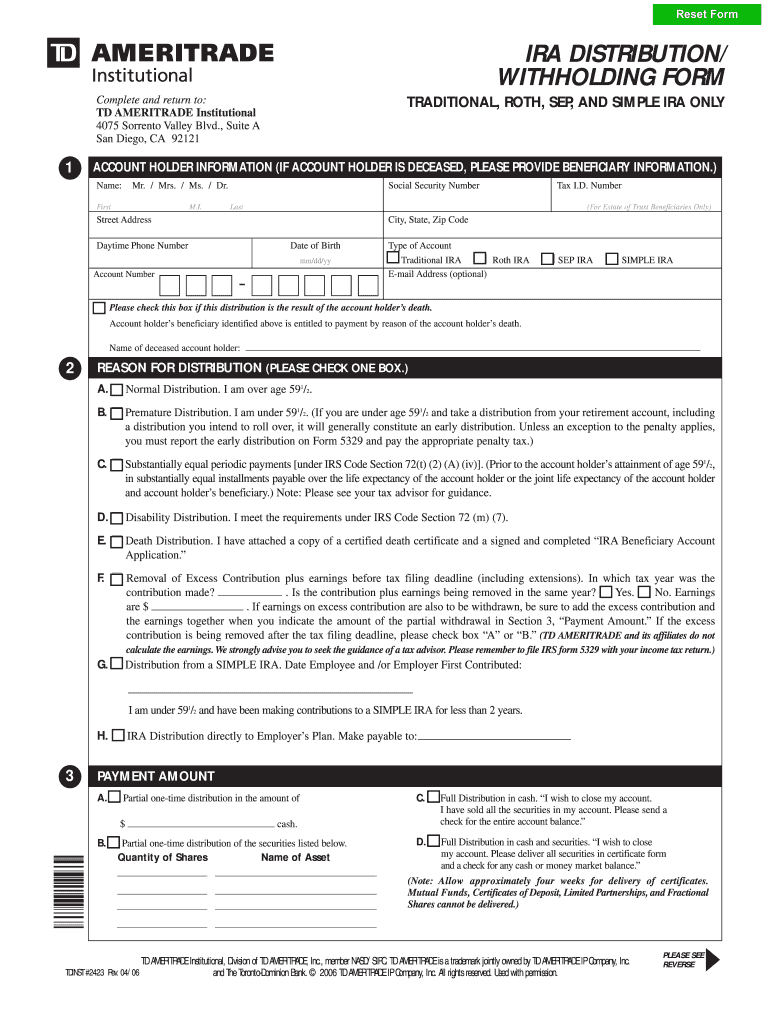

TD Ameritrade abides by IRS de minimus reporting regulations and we will not report amounts to the IRS that do not meet the thresholds it has put in place. Open an Account Now. TD Ameritrade will not report cost basis information on tax-exempt accounts to the IRS.

Or qualified foreign corporation and it is readily tradable on a US. Box 2e and Box 2f. I would clear that information out try the following steps below and then try to re-import.

I recently opened an account with TD Ameritrade. In addition to the information reported on a Consolidated Form 1099 shown at left TD Ameritrade uses the following forms. Mid-to-late February Mailing date for Forms 4806A and 4806B.

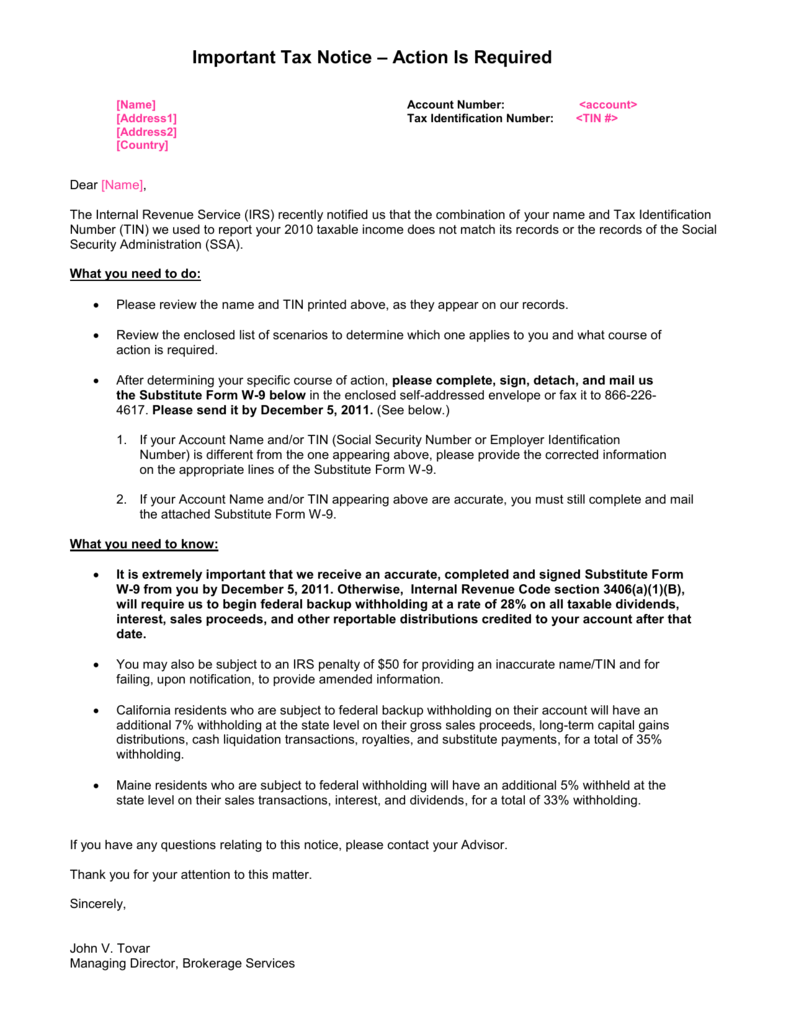

You may receive your form earlier. Do I need to report anything on my tax return if I havent withdrawn any funds from the account. If you have any questions please contact your Advisor or call TD Ameritrade Institutional at 800-431-3500.

No TD Ameritrade does not sell your personal information to anyone. The IRS has updated the 2021 Form 1099-DIV to include two new boxes. 175 Branches Nationwide Go City State Zip.

We expect 1099s to be available online by February 17 2022 by the IRS deadline. TD Ameritrade hosts an OFX server from which your 1099-B realized gain and loss information may be retrieved by our program. Anything else you want the.

You have to pay income tax in your own country and your income earned from the US is not taxed - other than whatever the US withhold. They only need the information they ask for personal use as every broker does. However TD Ameritrade does not report this income to the IRS.

A Consolidated 1099 Form which consists of. However if you have other. A Consolidated 1099 Form which.

Intraday data is delayed at least 20 minutes. Log completely out of Turbo Tax. Since January 1 2013 brokers are required to report options trades to the IRS.

Have you talked to a tax professional about this. Open an Account Now. To retrieve information from their server you will.

What other forms does TD Ameritrade use to report to the IRS. You must enter the gain or. TD AMERITRADE uses the following forms to report income and securities transactions to the IRS.

Like options-trading strategies the tax treatment of options trades is far from simple. The US IRS cant come and audit you however your. Shows the portion of the amount in.

Ad No Hidden Fees or Minimum Trade Requirements. What does TD AMERITRADE report to the IRS. What other forms does TD Ameritrade use to report to the IRS.

Upon settlement youll find the lots you selected applied to the Realized GainLoss tab and TD Ameritrade will send your selection on to the IRS once tax reporting time rolls.

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Get Real Time Tax Document Alerts Ticker Tape

Mr Rjb Jr S Td Ameritrade Statements March 2015 06 18 2015

Ameritrade Ira Distribution Withholding Form Fill Online Printable Fillable Blank Pdffiller

Logo Td Ameritrade Institutional

Td Ameritrade Says I Made 196k In 3 Months R Tax

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

Td Ameritrade Ofx Import Instructions

How To Report Other Receipts And Reconciliations Partnership Distributions Received On A 1099 B From Td Ameritrade On My Tax Return Quora

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

Deciphering Form 1099 B Novel Investor

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

What Are Qualified Dividends And Ordinary Dividends Ticker Tape